Human-Centered Design Toolkit

A guide to designing innovative, successful and human-centered financial products and services

Design and deliver innovative products and services that tap into emerging customer segments and help ensure customer loyalty. Find out how human-centered design can help your organization improve on its remittance and financial services today.

Human-centered design (HCD) is a problem solving framework.

HCD is approach to problem-solving that puts the customer you are designing at the heart of the process. In the HCD process, you will use tools to conduct customer research, gain insights, co-create innovative ideas, and develop desirable, feasible and viable solutions for customers.

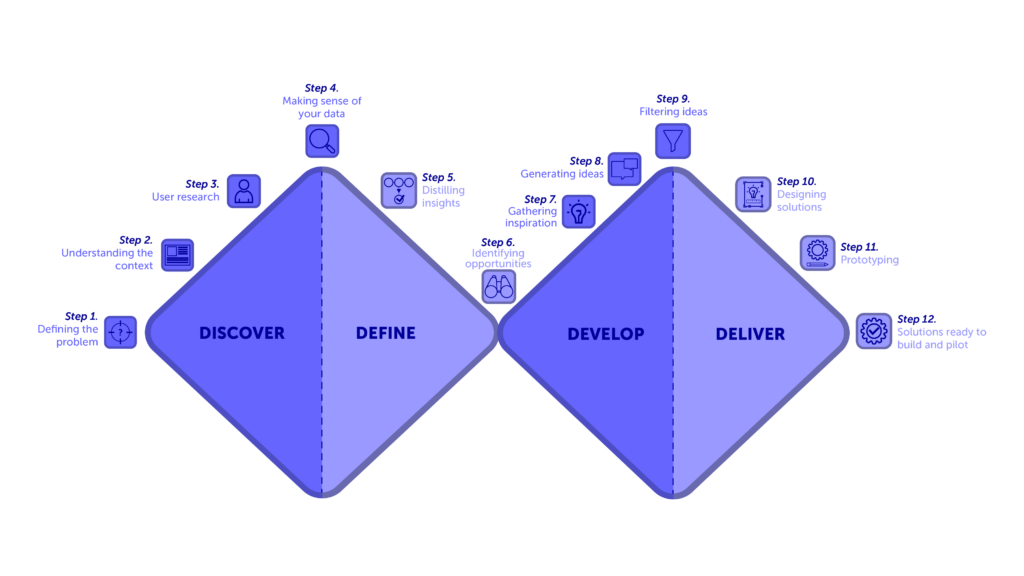

Each phase comprises a series of steps.

– Discover (Research): (Step 1) We begin with what we think our problem is. (Step 2) We explore the broader context of this problem. Step 3) We engage in customer research to expand our understanding of the problem.

– Define (Analysis): (Step 4) Once we have our customer data, we begin to make sense of it. (Step 5) We distil our data into insights. Step 6) We further narrow these insights into opportunity statements.

– Develop (Ideation): (Step 7) We gather inspiration from solutions around us. (Step 8) We generate our own creative ideas. (Step 9) We begin to filter our ideas.

– Deliver (Prototype): (Step 10) We further design solutions. (Step 11) We create a prototype.

Ultimately, the final product is our solution, ready to be built and piloted (Step 12).

The Double Diamond of design thinking

Are you curious about the added value of HCD in remittances?

What is the human-centered design toolkit?

The United Nations Capital Development Fund’s (UNCDF) Human-Centred Design (HCD) toolkit for Remittances consists of a website and field manual to support remittance and financial service providers (RSPs and FSPs) in creating human-centred digital remittances and remittance-linked financial services.

While many HCD toolkits are available, this toolkit is specifically designed to help RSPs, FSPs, and other service providers in the remittance industry create migrant-centric and gender-responsive products and services. The HCD toolkit is informed by research conducted in 2022 with RSPs and FSPs in Singapore, Bangladesh, Senegal, and the United Arab Emirates. UNCDF will continue to update this toolkit with new migrant-centric tools and case studies

How can this toolkit be applied?

Scenario #1: Financial services providers interested in developing new products and services with their internal product team

Scenario #2: Financial services providers outsourcing market research, HCD design services, or new product development

Scenario #3: Financial Service providers working directly with UNCDF to develop or improve new products and services